PropNex Picks

|November 12,2025A Bonanza Year For Executive Condominiums

Share this article:

Executive condominiums (EC) have been and continue to be a darling of the real estate market in Singapore. A public-private housing hybrid, EC projects which are more affordably-priced compared to other private condos command robust demand, particularly among HDB upgraders.

The biggest grouse perhaps has been the limited supply of ECs - up until now that is. In 2025, the HDB has through the twice-yearly government land sales (GLS) programmes set aside five new EC sites to be launched for tender in the year, more than twice the usual Confirmed List EC plots (specifically, two sites) launched each year in recent times. Meanwhile, the land rate for GLS EC sites also hit a record high in 2025.

Separately, the two new EC projects put on the market in 2025 have collectively sold 96% of their units as per caveats lodged (as at 16 October) - making it quite the bonanza year for this housing segment.

2025 saw the launch of two EC projects, Aurelle of Tampines EC in March and Otto Place EC in Tengah in July. Both projects were sought-after in view of their strong location attributes and pricing - underscoring the continued strength in the EC market amid tight new supply. As at end-September 2025, there were 66 remaining new EC units in the market, according to data from the Urban Redevelopment Authority (URA).

Aurelle of Tampines kicked off EC sales with a bang, selling 90% of its 760 units when it was launched, and was fully sold after sales booking opened to more second-timer buyers a month later. Meanwhile, the 600-unit Otto Place sold 59% of its units during its launch weekend, and subsequently hit 91% sales after second-timer balloting. Both ECs have achieved a median unit price of more than $1,700 psf each, setting a new price benchmark.

Despite the gradual rise in new EC prices, eligible EC buyers are still homing in on them, driven partly by private housing aspirations and the more accessible entry-prices of new EC units. Indeed, a PropNex consumer survey conducted in 2024 found that more than 4-in-10 of the respondents said ECs are still relevant in meeting the private housing aspirations of the middle- and upper-middle income households.

In addition, the price gap between new ECs and other new mass-market private condos will continue to spur interest for EC projects. Based on URA Realis caveat data, the median transacted unit price gap between new ECs ($1,754 psf) and that of 99-year, new non-landed private homes in the Outside Central Region ($2,254 psf) was around 29% in 2025 (till mid-October).

Another highlight in the EC market in 2025 was the infusion of more EC land supply. Five EC sites were placed on the Confirmed Lists of the two GLS programmes in the year, potentially yielding a combined 1,970 new EC units. This is to meet ongoing housing demand and also to help bolster the stock of new EC units on the market. All that makes for an exciting 2026 and 2027, where these new EC projects could be launched for sale.

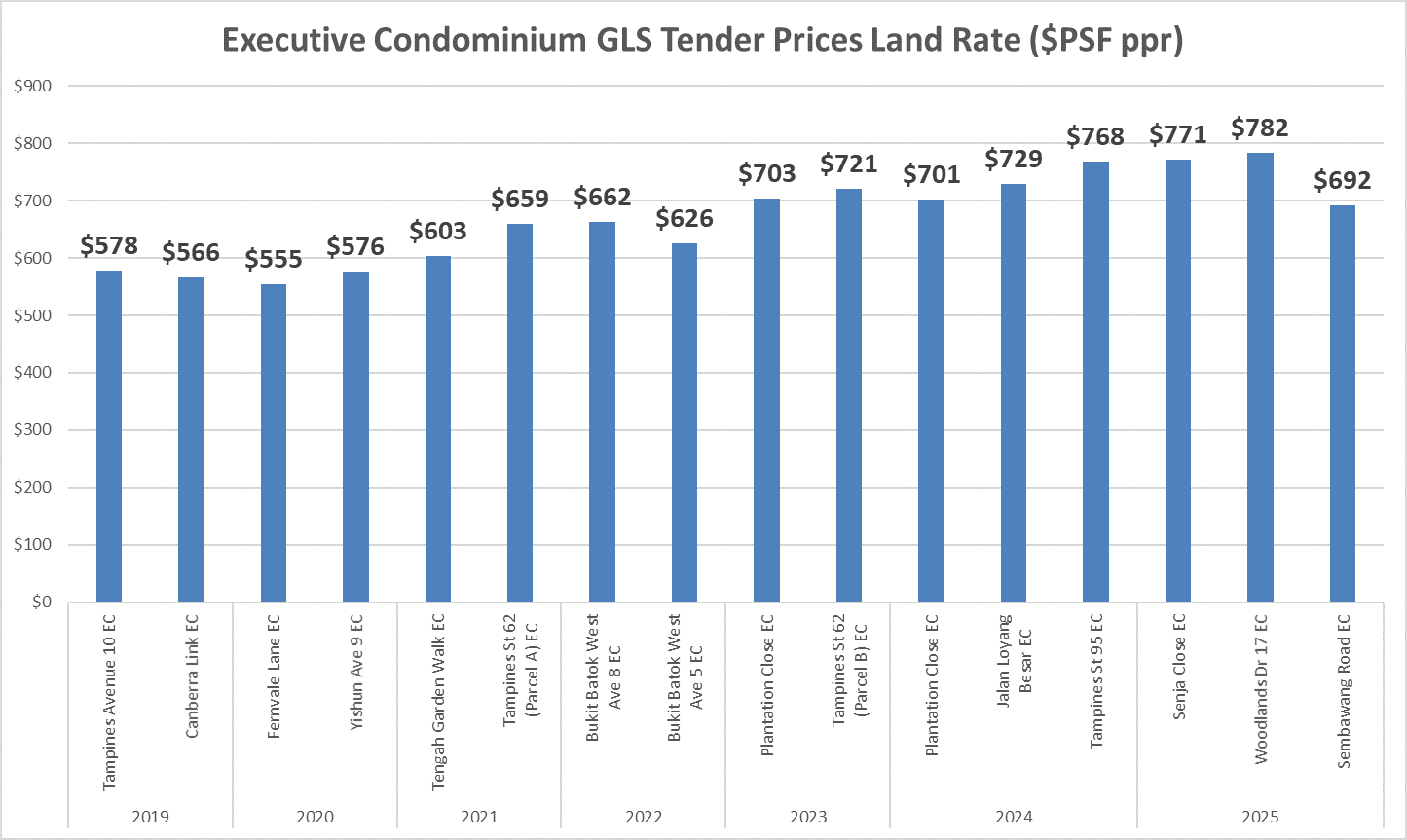

At the time of writing, three EC sites - offering an estimated 980 units overall - in the GLS programme in the first half of 2025 have been awarded. They comprised sites in Senja Close, Woodlands Drive 17, and Sembawang Road. Of note, the Senja Close and Woodlands Drive 17 EC sites received record-breaking land bids of $771 psf and $782 psf, respectively (see Chart 1) - beating the previous record land rate of $768 psf for the Tampines Street 95 EC site. Meanwhile, the Sembawang Road EC plot was sold for $692 psf, partly due to its location further away from the MRT station.

Chart 1: EC GLS Tender Prices Land Rates ($PSF ppr)

Two more EC sites - another in Woodlands Drive 17 and Miltonia Close - in the GLS programme in the second half are set to add another 990 EC units to the roster. With the first Woodlands Drive 17 EC plot garnering five bids and achieving a record land rate, PropNex expects the second plot could also be hotly contested. What is clear is that the pipeline of new EC launches will offer many first-time homebuyers and HDB upgraders more opportunities to enter the private housing market.

If 2025 was a bonanza year for the EC segment, then 2026 could be another banner year for the EC market - especially considering the potential number of new projects that may be launched. The 748-unit Coastal Cabana EC in Pasir Ris will get the ball rolling when it hits the market in January 2026. It is expected to enjoy healthy interest and pent-up demand, since there have been no EC launches in Pasir Ris since Sea Horizon was launched in 2013.

Meanwhile, Rivelle Tampines EC in Tampines Street 95 which can offer an estimated 560 units may also be launched in Q1 2026. This is a highly-anticipated EC launch given its proximity to the Tampines West MRT station on the Downtown Line, as well as an upcoming mixed-use project nearby. Other EC projects that could possibly be rolled out at the latter part of 2026 may include the Senja Close and the first Woodlands Drive 17 sites.

With the moderation in interest rates, PropNex believes many prospective homebuyers may be encouraged to make their move in 2026. Furthermore, buyers of new ECs can tap the Deferred Payment Scheme which will help them to better manage their cashflow. All in, 2026 holds plenty of promise for the EC market.

Contact a PropNex agent to find out how you can secure your dream EC unit.